Financial Inclusion

Building Bridge for Access to Financial Services

Experience from large scale projects shows access to finance, at affordable price, for desired amount and customised repayment terms is crucial for poor and vulnerable group of the society, to meet their consumption, exit debt trap and investment in livelihood assets. Thus, NSRLM facilitatesbuilding bridge for universal access to affordable cost-effective reliable financial services to the poor through their SHGs and their federations. These include financial literacy, bank account, savings, credit, insurance, remittance, pension and counselling on financial services.

Capitalizing Institutions of the Poor

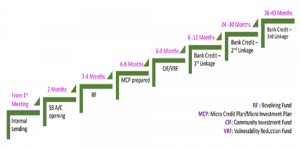

NSRLM provides Revolving Fund and Community Investment Fund (CIF) as Resources in Perpetuity to the institutions of the poor for meeting their credit needs for both consumption purposes and also for investment in livelihoods promotion. This fund is a corpus /capital resource for institutions of the poor. Largely this fund is used for on-lending to the SHGs for providing financial assistance. This also strengthen their institutional and financial management capacity and build their track record to attract mainstream bank finance.

- Revolving Fund (RF) is provided to SHGs as corpus to meet the members’ credit needs directly and as catalytic capital for leveraging repeat bank finance. RF is given to SHGs that have been practicing ‘Panchasutra’ (Regular meetings; Regular savings; regular inter-loaning; Timely repayment; and Up-to-date books of accounts).

- Community Investment Fund is provided as Seed Capital to SHG Federations at Cluster level to meet the credit needs of the members through the SHGs/Village Level Organizations and to meet the working capital needs of the collective activities at various levels.

- Vulnerability Reduction Fund (VRF) is provided to SHG Federations at Village level to address vulnerabilities like food security, health security etc., and to meet the needs of the vulnerable persons in the village.

Access to Credit

NSRLM expects that the investment in the institutions of the poor would leverage the bank credit of at least Rs.1,00,000 /- accessible to every household in repeat doses over the next five years.For this, SHGs go through Micro-Investment Plan (MIP)/Micro Credit Plan (MCP) process periodically. MIP/MCP is a participatory process of planning and appraisal at household and SHG levels. The flow of the funds to members/SHGs is against the MIPs. The rural poor need credit at low rate of interest and in multiple doses to make their ventures economically viable.In order to ensure affordable credit, DAY-NRLM has provided interest subvention for all eligible SHGs to get loans at 7% per annum from mainstream financial institutions. Further, additional 3% interest subvention is available only on prompt repayment by SHGs in most backward 250 districts.Making poor the ‘preferred clients of the banking system and mobilizing bank credit’ is core to the DAY-NRLM financial inclusion and investment strategy.

SHG Credit Linkage

In order to facilitate bank linkages, State Level Bankers’ Committees (SLBC) has constituted exclusive sub-committee for SHG bank linkages and financial inclusion in NSRLM activities. Similarly, District Level Coordination Committees and Block Level Coordination Committees reviews SHG-Bank linkages and NSRLM.

SHG members are fostered as Bank Facilitators (Bank Sakhi) to drive Financial Inclusion in their community. They facilitate close interaction between the community and the Bank Branch in addressing financial needs of the SHGs, and for 100% recovery of loans through Community Based Recovery Mechanism (CBRM) positioned in the banks. CBRM is monitored by the ‘Sub Committee on Bank Linkage and Recovery of Loans’ under the Village Level Organisation.

To ensure banking services is delivered at the doorstep for unbanked and underbanked area, SHG members are engaged as Business Correspondent (BC) as an alternate banking solution for the rural community.

NSRLM works towards increasing the portfolio of products of savings, credit, insurance (life, health and assets) and remittance through the institutions of the poor directly or in partnership with mainstream financial institutions using various institutional mechanisms and technologies.